The Great Business Show with Conall O’Móráin

Listen to Graham and David have a great chat with Conall about Global Health Capital and st…

Because delayed payments shouldn’t delay your practice.

Due to launch in 2026, a multi-year term loan tailored for investment, expansion or leveraging Sláintecare reforms — with fixed repayments and long-term stability.

At GHC, we design smart funding solutions that match the pace, complexity, and demands of medical life — from first practice to full-scale expansion.

GHC

GHC

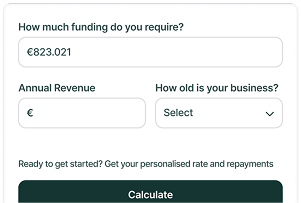

Tell us a few details online and get an instant pre-approved amount or quote — no commitment, no paperwork, just a number.

Happy to proceed? Upload your ID and core documents — we’ve kept it light-touch and hassle-free.

Once approved and terms are agreed, funds land fast — in some cases, under 24 hours from application to payout.

To be eligible for GHC funding, you must meet all of the following criteria:

Whether you’re starting out or scaling up, GHC gives doctors fast, flexible funding without the stress. No hoops. Just help.